Pennsylvania Property Inheritance Tax . 0 percent on transfers to a surviving spouse or to a parent from a. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. Input the estate value and. the pennsylvania inheritance tax is a transfer tax on the transfer of assets from the deceased pennsylvanian (or. • 0 percent on transfers to a. if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. 100k+ visitors in the past month the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: the rates for pennsylvania inheritance tax are as follows:

from www.formsbank.com

the rates for pennsylvania inheritance tax are as follows: Input the estate value and. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. the pennsylvania inheritance tax is a transfer tax on the transfer of assets from the deceased pennsylvanian (or. if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. • 0 percent on transfers to a. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. 0 percent on transfers to a surviving spouse or to a parent from a. the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: 100k+ visitors in the past month

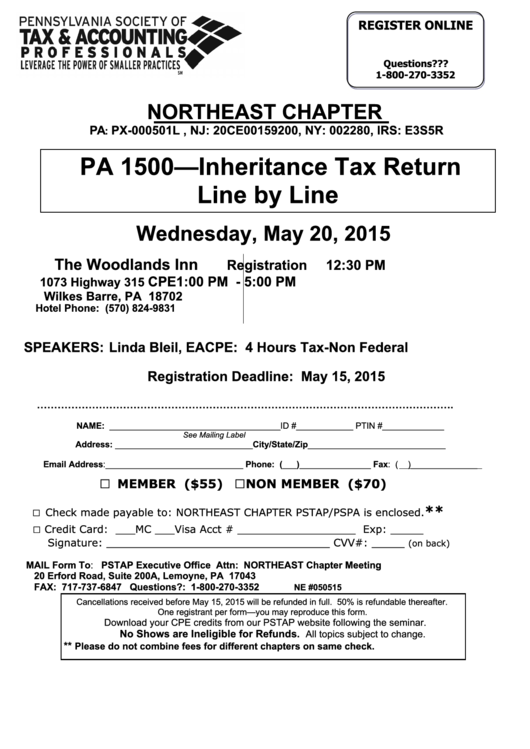

Pa 1500 Inheritance Tax Return Line By Line printable pdf download

Pennsylvania Property Inheritance Tax 100k+ visitors in the past month the rates for pennsylvania inheritance tax are as follows: 0 percent on transfers to a surviving spouse or to a parent from a. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. 100k+ visitors in the past month if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. the pennsylvania inheritance tax is a transfer tax on the transfer of assets from the deceased pennsylvanian (or. Input the estate value and. • 0 percent on transfers to a. the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows:

From www.courtneylaw.net

Is an Inheritance Considered Marital Property in Pennsylvania? Law Pennsylvania Property Inheritance Tax if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. the pennsylvania inheritance tax is a transfer tax on the transfer of assets from the deceased pennsylvanian (or. 0 percent on transfers to a surviving spouse. Pennsylvania Property Inheritance Tax.

From pinoydwellings.com

Real Estate 101 What is Inheritance Tax and Estate Tax? What’s the Pennsylvania Property Inheritance Tax 0 percent on transfers to a surviving spouse or to a parent from a. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. the rates for pennsylvania inheritance tax are as follows: the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: • 0 percent on transfers to a.. Pennsylvania Property Inheritance Tax.

From www.formsbank.com

Form Rev1500 Ex Inheritance Tax Return Resident Decedent Pa Dept Pennsylvania Property Inheritance Tax if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. 0 percent on transfers to a surviving spouse or to a parent from a. the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: use our pennsylvania inheritance tax calculator to estimate inheritance tax on. Pennsylvania Property Inheritance Tax.

From www.behrend-ernsberger.com

PA Inheritance Tax Calculator Behrend Ernsberger PC Law Firm Pennsylvania Property Inheritance Tax 100k+ visitors in the past month • 0 percent on transfers to a. the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. 0 percent on transfers to a surviving spouse or to a parent from a. Input the estate value. Pennsylvania Property Inheritance Tax.

From www.ar15.com

Proposed tax increase for PA residents Pennsylvania Property Inheritance Tax the pennsylvania inheritance tax is a transfer tax on the transfer of assets from the deceased pennsylvanian (or. Input the estate value and. 0 percent on transfers to a surviving spouse or to a parent from a. the rates for pennsylvania inheritance tax are as follows: • 0 percent on transfers to a. the rates for pennsylvania. Pennsylvania Property Inheritance Tax.

From www.formsbank.com

Fillable Pennsylvania Inheritance Tax printable pdf download Pennsylvania Property Inheritance Tax the rates for pennsylvania inheritance tax are as follows: 0 percent on transfers to a surviving spouse or to a parent from a. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. if you're a pennsylvania resident, or if you own real estate or tangible property located in. Pennsylvania Property Inheritance Tax.

From www.awesomefintech.com

Inheritance Tax AwesomeFinTech Blog Pennsylvania Property Inheritance Tax 100k+ visitors in the past month the rates for pennsylvania inheritance tax are as follows: use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: Input the estate value and. 0 percent on transfers to a surviving spouse or to. Pennsylvania Property Inheritance Tax.

From www.youtube.com

PA Inheritance Tax and Federal Gift and Estate Tax Part 1 YouTube Pennsylvania Property Inheritance Tax 0 percent on transfers to a surviving spouse or to a parent from a. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. the rates for pennsylvania inheritance tax are as follows: the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: if. Pennsylvania Property Inheritance Tax.

From mypersonalcfo.com

17 States that Charge Estate or Inheritance Taxes My Personal CFO Pennsylvania Property Inheritance Tax use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. 100k+ visitors in the past month Input the. Pennsylvania Property Inheritance Tax.

From www.formsbirds.com

REV1500 Inheritance Tax Return Resident Decedent Free Download Pennsylvania Property Inheritance Tax the rates for pennsylvania inheritance tax are as follows: Input the estate value and. 0 percent on transfers to a surviving spouse or to a parent from a. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. the pennsylvania inheritance tax is a transfer tax on the transfer. Pennsylvania Property Inheritance Tax.

From acornlaw.net

Pennsylvania Inheritance Tax 5 Simple Ways to Minimize the Tax Burden Pennsylvania Property Inheritance Tax Input the estate value and. 100k+ visitors in the past month if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. • 0 percent on transfers to a. the rates for pennsylvania inheritance tax as of. Pennsylvania Property Inheritance Tax.

From www.signnow.com

Pennsylvania Disclaimer of Inheritance Form Complete with ease Pennsylvania Property Inheritance Tax the rates for pennsylvania inheritance tax are as follows: all real property and all tangible personal property of a resident decedent, including but not limited to cash,. if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. the rates for pennsylvania inheritance tax as of july 1, 2000. Pennsylvania Property Inheritance Tax.

From cccpa.com

All You Need to Now About Inheritance Taxes at Federal and State Level Pennsylvania Property Inheritance Tax • 0 percent on transfers to a. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. 100k+ visitors in the past month the rates for pennsylvania inheritance tax are as follows: the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: use our. Pennsylvania Property Inheritance Tax.

From reineqcaresse.pages.dev

Inheritance Tax 2024 Usa Buffy Cathryn Pennsylvania Property Inheritance Tax the rates for pennsylvania inheritance tax are as follows: the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: the pennsylvania inheritance tax is a transfer tax on the transfer of assets from the deceased pennsylvanian (or. all real property and all tangible personal property of a resident decedent, including but not. Pennsylvania Property Inheritance Tax.

From www.finance-review.com

You may have to read this about Pennsylvania Inheritance Tax Rates Pennsylvania Property Inheritance Tax 100k+ visitors in the past month the rates for pennsylvania inheritance tax are as follows: the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: Input the estate value and. • 0 percent on transfers to a. 0 percent on transfers to a surviving spouse or to a parent from a. use our. Pennsylvania Property Inheritance Tax.

From www.formsbirds.com

Pennsylvania Inheritance Tax 39 Free Templates in PDF, Word, Excel Pennsylvania Property Inheritance Tax the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: the rates for pennsylvania inheritance tax are as follows: if you're a pennsylvania resident, or if you own real estate or tangible property located in pennsylvania, the. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. 100k+ visitors. Pennsylvania Property Inheritance Tax.

From www.youtube.com

Tax Reduction Strategies for the PA Inheritance Tax YouTube Pennsylvania Property Inheritance Tax use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. • 0 percent on transfers to a. all real property and all tangible personal property of a resident decedent, including but not limited to cash,. the rates for pennsylvania inheritance tax as of july 1, 2000 are as follows: 100k+ visitors in the past. Pennsylvania Property Inheritance Tax.

From taxfoundation.org

Weekly Map Inheritance and Estate Tax Rates and Exemptions Tax Pennsylvania Property Inheritance Tax • 0 percent on transfers to a. use our pennsylvania inheritance tax calculator to estimate inheritance tax on an estate. Input the estate value and. the rates for pennsylvania inheritance tax are as follows: 100k+ visitors in the past month all real property and all tangible personal property of a resident decedent, including but not limited to. Pennsylvania Property Inheritance Tax.